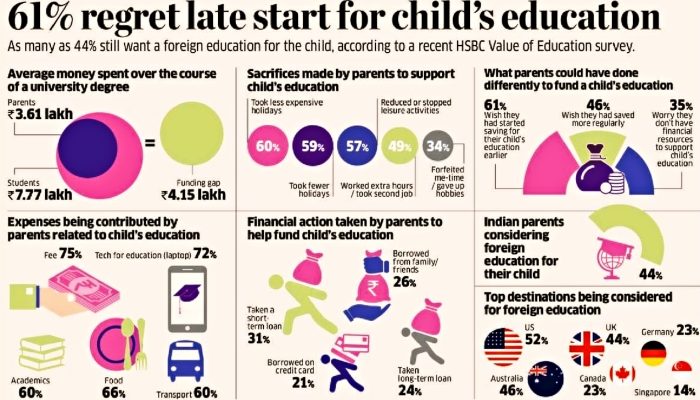

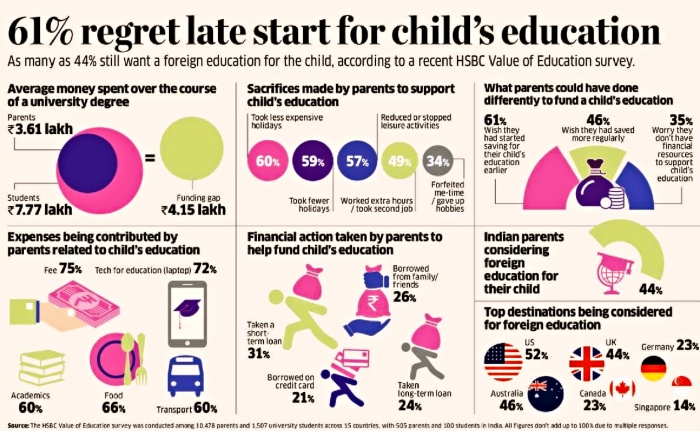

Many of us dream of sending our children abroad for foreign education.

Studying in a foreign university was once a dream of only the uber intelligent or the super-rich. But now the majority aspire for a foreign degree. And for good reason too. The supply of quality education in India is outstripped by demand.

The cut-off percentage for some of the coveted courses in top colleges has hit 99%. The acceptance rate in Indian colleges offering quality education is below 2 %. This has forced many to look for education overseas.

How much does it cost?

Studying abroad can be prohibitively expensive. If you plan to send your child abroad, keep a target of at least Rs. 50 lakh for a 3-year course. In 10 years, the present cost of 50 lakh would have risen to Rs. 1.07 cr. An eight-figure amount may seem daunting right now, but is achievable with disciplined investing.

Easy for early birds

The goal is easily achievable for early starters. The SIP required will not be prohibitively high. Equity funds should be the preferred investment class if you have more than 7 years before the goal.

Options for late starters

The ideal strategy would be to start any SIP along with lump sum investments.

Hopefully, you do not become part of the 61% who regret starting late in saving for their child’s education.