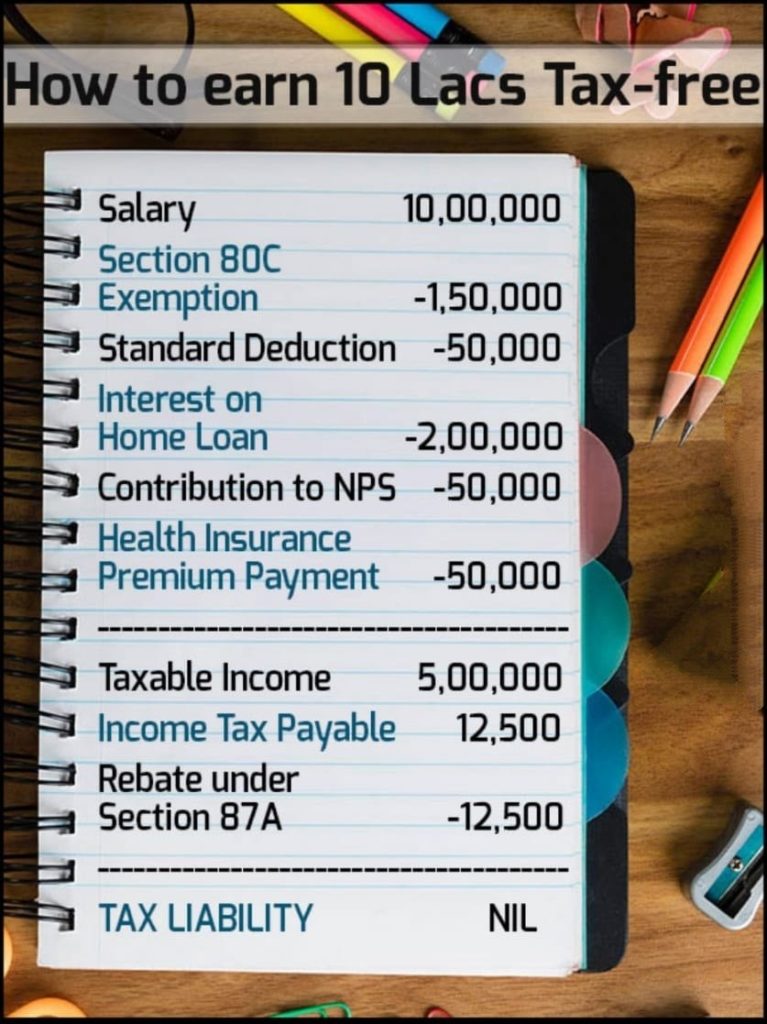

It is said that there are only two things certain in life: Death and Taxes. Well this no longer stands true. At least in case of taxes, it is possible for someone earning up to 10 lakhs to be exempt from paying taxes.

So how can one avail of this benefit?

To understand this better, first let’s understand the income tax slabs for individuals.

Last year Aman’s net taxable income was 5 lakh, so the tax payable comes to Rs. 12,500/-. However, this year someone with a similar salary will be eligible for a tax rebate of Rs. 12,500/- which effectively means this person will not pay income tax.

How does one ensure that the net taxable income stays within the magic ✨ figure of Rs. 5 lakh?

1. The most widely used option to save income tax is section 80C – Eligible investments include contributions to Provident Fund, ELSS mutual funds, tax saving FDs, NPS, and a few other options. An individual can reduce up to Rs. 1.5 lakh from their taxable income.

For example, if your gross total income is Rs 7.5 lakh and you have claimed a deduction of Rs 1.5 lakh under Section 80C, your taxable income becomes Rs 6 lakh.

2. Have a home loan – Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest.

3. NPS – If you are a salaried individual and have already exhausted the₹ 1.5 lakh Section 80C income tax benefit, the NPS could help you with additional tax savings. Investment of up to ₹ 50,000 in the National Pension Scheme qualifies for additional tax deduction.

4. Insurance – A must in your financial portfolio, the government encourages everyone to buy medical 💉insurance and allows you to avail tax deductions on it.

An individual can claim a deduction of up to Rs 25,000 for the insurance of self, spouse, and dependent children. An additional deduction for the insurance of parents is available to the extent of Rs 25,000 if they are less than 60 years of age, or Rs 50,000 if your parents are aged above 60.