Around Dec – Jan every year, you get an email from your HR about submitting the investment proofs for the financial year which sends all of us into a bit of panic.

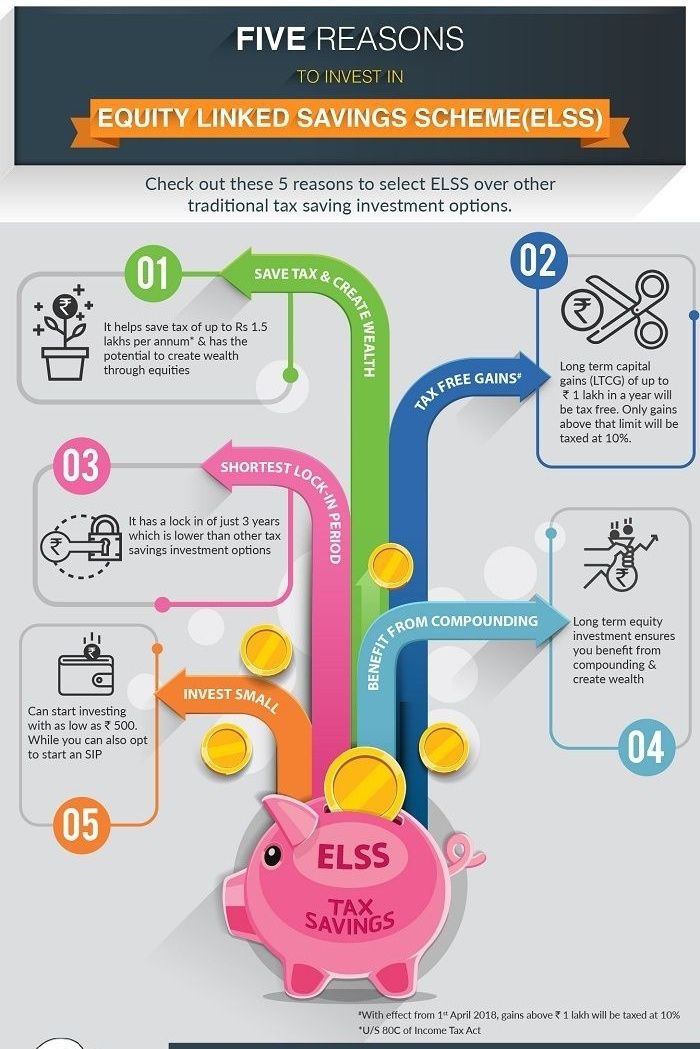

Your colleague advises you to invest in ELSS, your bank manager says an insurance policy is a better idea. Your parents will suggest to go with the time tested PPF. Or should you go with Ulips or Bank FDs?

Where should you invest to save taxes?

Let’s look at the last 5 years returns

- Public Provident Fund – 8%, money locked in for 15 years.

- Ulips – around 10.5%, 5 years lock in period.

- Tax Saving Bank FDs – 8%, 5 years lock in period.

- NSC – 8%, 5 years lock in period.

- Tax Saving Mutual Fund (ELSS) – 16.5%, 3 years lock in period.

The worst performing ELSS fund has also given 11% return.

Tax Savings Bhi!

Tarakki Bhi!!