Ajay and Neha were relieved, the home loan which they had taken 20 years ago was finally over. They had taken a 50 lakh loan at an interest rate of 9% and the EMI worked out to 45k monthly whereas they had budgeted for 50k so they decided to invest the difference – 5k.

Every month they paid 50k, and over these 20 years had paid the Principal amount of Rs. 50 lakh plus interest of Rs. 58 lakh, a total of 1.08 cr.

When they went to the bank to collect the original documents and NOC from the bank, they were in for a pleasant surprise. At the time of disbursement of the loan, the monthly investment of 5k which they had started in a Mutual fund, is now worth close to 58 lakhs, which is the amount of interest paid on the loan.

Would you also like to make your Home Loan Interest-free?

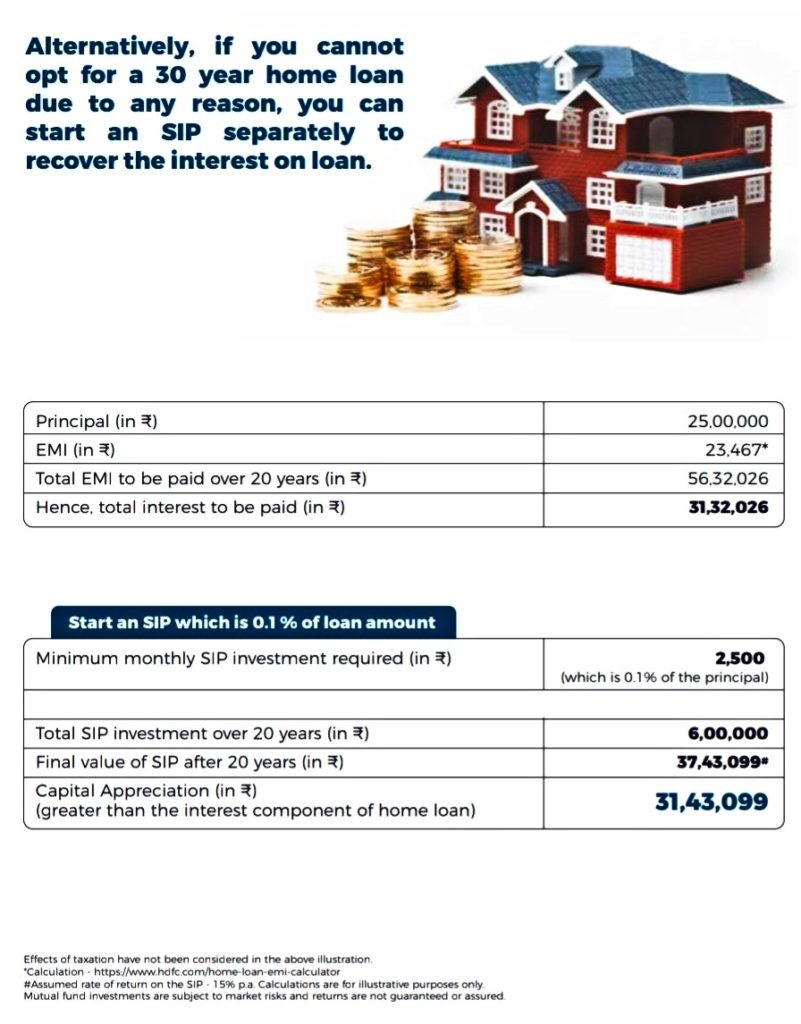

Simple. Start an SIP which automatically deducts 0.1% of the home loan amount on the same day as that of your home loan. You won’t even notice it, but will be elated when you receive the big fat paycheck at the end of 20 years.

Increase the SIP amount to 0.2% of loan amount and you will get back the Principal and Interest amount.