I met a college friend after a long time. After reminiscing about canteen, professors and the college beauty queen, I started complaining about my crappy job and how I would love to retire in ten years.

Yeah, said Aditya. That’s the trend these days. FIRE: Financial Independence, Retire Early.

Makes sense, I said. If I could do that. Then I could pursue my farming hobby full time. Everyone wants to retire early, but am I ready? Am I rich enough?

Learn this financial planning tool to know for sure. First of all, let’s ask ourselves how much money is enough? How much do I need to have to call myself rich?

Practically speaking, being very rich actually means that the amount of savings you have is more than sufficient to ensure that your lifestyle of choice is assured and there is little risk to that. Please note, the phrase is ‘lifestyle of choice’ and not ‘extravagant lifestyle’.

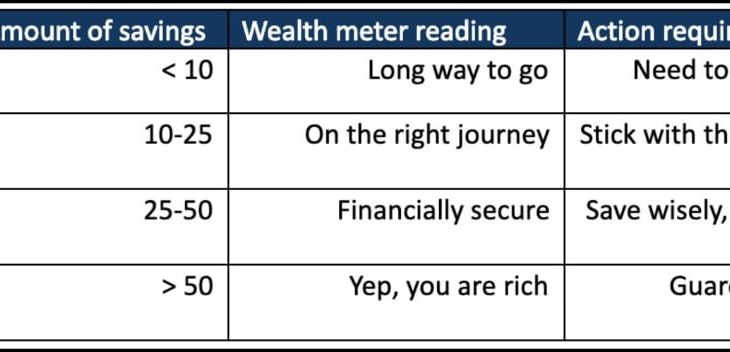

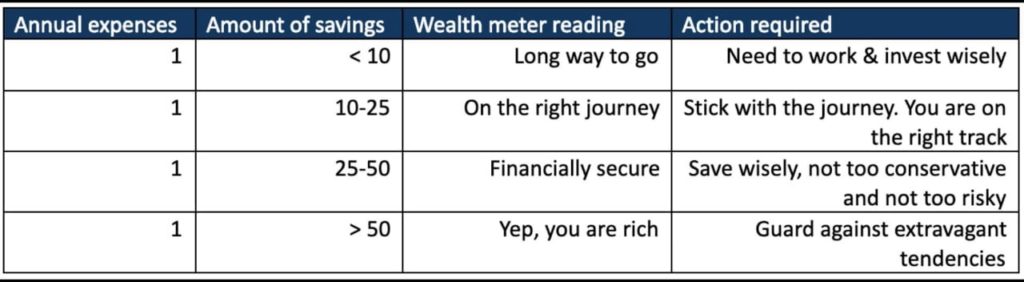

Assuming your annual expenses equal 10 lakh. The amount of savings required is directly linked to your yearly expenditure. One needs a minimum of 25 times your annual expenses (2.5 cr) to lead a comfortable retirement.

It is very important to note that when we say savings we are talking about liquid financial assets. Not illiquid business assets, gold or real estate which may or may not yield fruits. To be more specific, assets which beat inflation because your expenses will double every 12 years.

Calculate for yourself. Where you are currently on the Richie Rich Scale?