A friend recently got a call from HDFC about a new investment cum insurance plan – HDFC Sanchay Guaranteed Income Plan.

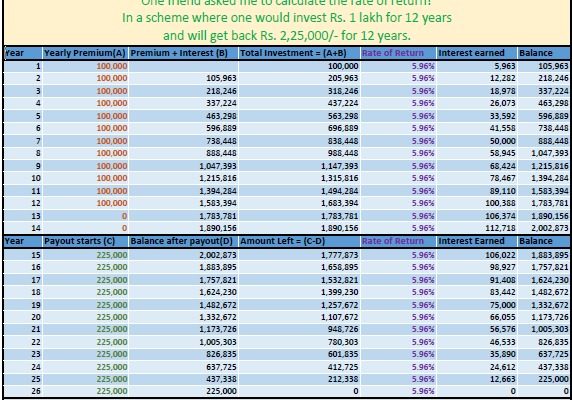

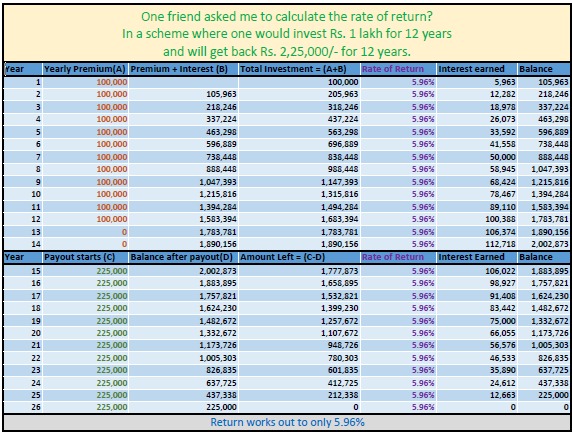

Pay a premium of Rs 1 lakh for 12 years and the policy will pay a guaranteed income of Rs 2.25 lakhs from the end of the 14th year (they could have also said from the start of 15th year) for 12 years. The telecaller continues – Sir the return is more than 9%, plus you get term cover of 12 lakh and the best part is that the returns are guaranteed.

Fantastic! I’ll pay only 12 lakh and get 27 lakh in return. What more can one ask for in an investment.

Well, like they say – the devil 😈 is always in the detail.

The so called 9% GUARANTEED INCOME may appear enticing for you to jump with joy. But when you actually calculate the return on investment then you will realise that it is not more than 6%.

So should you invest in HDFC Life Sanchay Plus or similar products?

If you are looking at wealth creation, this is clearly not the right product. For a long term investment, 6% per annum is definitely not something worth settling for. A Provident Fund or Fixed Deposit will fetch you much higher returns. You may argue that the PF/FD interest rates keeps changing. However, 6% is still rather low. You can expect much higher returns in equity funds too.

If you are looking to add to your life cover☂, again a 12 lakh cover will not do much for your insurance portfolio.

Conclusion – It is more advisable to invest in a diversified portfolio depending upon one’s risk profile. Systematic withdrawal from a MF portfolio is a good option.

A Guaranteed Income Plan or A GUARANTEED TRAP!!