Dhanteras marks the first day of Diwali. It is one of the most auspicious times (Muhurats) to buy gold. This is when millions of Indians buy gold, either to wear or as a form of investment.

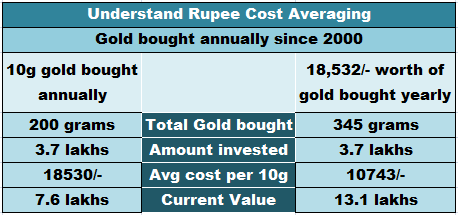

Since 2000, Abhishek has been buying 10 grams of gold every year on Dhanteras. This year is no different. Over the past two decades, he has accumulated 200 grams of gold. Abhishek is very happy with the appreciation of the yellow metal which is currently selling for about 38,000/- for 10 grams of 24 carat. “I’ve invested 3.7 lakhs which is currently worth 7.6 lakhs. My average cost of buying 10 grams over these years is Rs 18,500.”

Abhishek’s wife Aishwarya, also bought gold every year. She, however, invested a fixed amount of Rs 18,500 every year. So she has also invested 3.7 lakh in gold but accumulated 345 grams of gold over the past two decades. The current value of her investment is 13.1 lakhs.

How did Aishwarya accumulate so much more Gold than Abhishek?

Aishwarya invested a fixed amount of money every year, irrespective of the price of Gold. There were times when Gold was available for 5,000 or 10,000, when she accumulated more gold. When gold was available for 30,000, she got less. So this Dhanteras, if the price of Gold is 38k for 10 grams, she will invest 18.5k and accumulate about 5 grams of gold.

This is nothing but Rupee Cost Averaging which ensures that you buy more when prices are low and less when prices are high. By investing on a fixed schedule, you avoid the complex or even impossible task of trying to figure out exactly the best time to invest. Sadly, most investors end up doing just the opposite. They start buying when the prices are rising and suddenly redeem upon a slump. Ultimately, their average cost of investing increases and returns fall.

Can Aishwarya’s investing philosophy be replicated while investing in the stock market?

Yes. Rupee Cost Averaging is the SIP Advantage; One of the major reasons to invest in the stock market via SIPS instead of in a lump sum. Since like the price of gold, the purchase price of various funds also fluctuates.

Why should you SIP?

SIPs impart financial discipline to your life.

Many people have the mentality that they should invest only after they have saved a sizeable amount. This can delay the investment for a long time. SIPs are so effective because you can get started fairly easily with a small amount of money, and invest consistently over time which enables us to achieve our financial goals.

SIPs take the emotional factor out of investment decisions which can really serve you well.

It helps you to invest regularly without wrestling with the current index level or the market mood. If you decide to manually invest a specific amount every month, you need to find the time to do it. When you do, you might be worried about market conditions and consider postponing your investments. Or invest more if the market sentiment is optimistic. SIPs put an end to all these predicaments. The money is invested effortlessly.