In our day-to-day life, we find many people who will only buy a specific brand of clothes, go to the same store each time or take the same route to reach the store. These are examples of familiarity bias in our routine life.

The familiarity bias is very commonly observed in investing, too.

Raj, an IT professional, steered clear of equity investment for the first decade after he started earning. Instead, he invested in what he considered tried and tested “safe” investments like PPF and fixed deposits. “I had always seen my parents rely on these options, so I followed suit. I thought mutual funds were riskier, so I stayed away from them”.

Familiarity bias is like being at a party where it’s easier to chat with friends than mingle with strangers — but it can lead to sub-optimal diversification as investors stick to familiar ‘go to’ assets, rather than exploring the entire universe of options.

How to Overcome the Familiarity Bias?

The most important step in overcoming the familiarity bias is to accept that familiar is not necessarily safe.

For most of us, investing isn’t a full-time job. We don’t have time to understand the pros and cons of every possible investment. As a result, when making investment decisions, we try to make things simpler for ourselves by gravitating towards what’s familiar. For example, we may only invest in companies with brands that we recognize or in companies our family or friends invest in.

Sometimes the comfort zone can be a dangerous place.

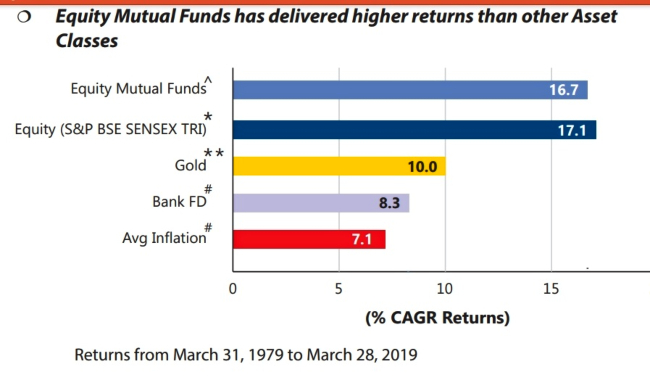

For example, if you invest only in familiar instruments like fixed deposits, gold or real estate, and not diversify. Since you are not spreading your risk by investing in different avenues, a downturn in that asset class will bring down your entire portfolio. Also if you have chosen a class that gives low returns, you will run short of funds for a particular goal.

Benjamin Graham in ‘The Intelligent Investor’ has rightly said that the investor’s chief problem and his worst enemy is likely to be himself. All too often, people deviate from rational behaviour due to behavioural biases. A rational decision, however, is made by taking all available information into account and weighing benefits and costs.