Another horrible commute.🚗🚙

A highly unpleasant interaction with a know-it-all😏 colleague.

A manager that seems to pile on more work every day – and yet isn’t nearly so generous with the recognition🙌.

And the work itself. What (hopefully) seemed exciting early📆 on has now completely lost its luster😮💨.

The question is: How can I enjoy a fulfilling life as I leave my job behind?

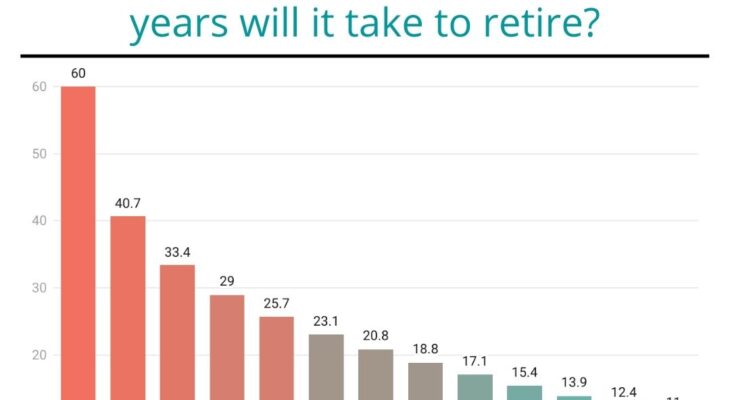

Your savings rate is the percent of your take-home💳💲💸 you’re investing🏦 long-term. Say you have no savings currently and you start investing 45% of your take-home; you’ll have enough to retire in a little more than 15 years!😲

This is assuming your investments💰 grow at 10% annually. (Historically Nifty 50📈 has grown at about 13.4% annually).

The retirement multiple I use is 30 times your annual spending. Annual spending is everything other than your savings. So, when you increase⬆️ your savings rate, it helps in two ways: By increasing🔼 investing and reducing🔻 spending!

Undoubtedly, 10% compounded🌱🌳 over 15 years📆 will be highly fruitful🥭.

But with shorter time⏳ frames like 5 or 10 years, it’s the savings rate that works the magic.

As we increase the percentage of our income we invest, we buy years of financial💰 freedom🆓 in the future.

I’m not suggesting we stop enjoying🍹 our lives. We just choose how to. There are many things I spend extravagantly on:

Holidaying at the Taj Holiday Village, Goa🏖️

Adding to my sneaker collection👟

There are also plenty of things I hardly spend any money on.

Owning a fancy car🏎️

Wearing an expensive watch⌚

Why? Because these are just not part of my rich💎 life. Maybe they are for you and that’s great.👍🏽

What is your current savings rate?

Could you hike⬆️ it by 5 or 10 percent if it meant being financially independent years sooner?🧐