We are living in a world that is changing dynamically.

Reading the summary has replaced reading a book.

Crash diets have replaced exercises.

In today’s age of instant gratification, a few investors may be upset that their SIP has not grown enough in a year.

Though the world is changing dynamically, a day is still made up of 24 hrs, a year of 365 days.

Hitting the gym today will not make us fit by tomorrow.

Reading a page of a book today will not make us wise by tomorrow.

Investing today will not make us rich by tomorrow.

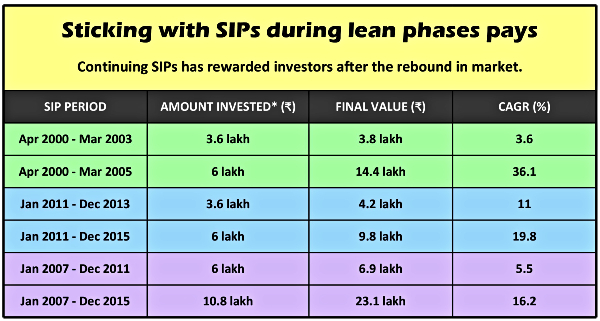

But when given time, thanks to rupee cost averaging and compounding effect, SIP helps in amassing wealth.

Someone who started investing Rs.10k from Jan’ 07 to Dec’ 11, would have invested 6 lakh and it’s value would be 6.9 lakh: a return of only 5.5%.

Kotak or YES Bank savings account would have given better returns.

However if the SIP was continued till Dec’ 15, the amount invested would have been 10.8 lakh and it’s value would be 23.1 lakh: a staggering return of 16.2%.