I was talking to my mom about our house in Pune. My elders had bought the flat for 1 lakh in 1978 and today it is worth 1 crore.

💯times growth in 40 years. Wow, that’s FANTASTIC! 🤩🥳 I’m sure you have heard such success stories from your relatives and neighbors.

Let us dig deeper to figure out the actual return I made. When I calculated, it comes to 11.81%.

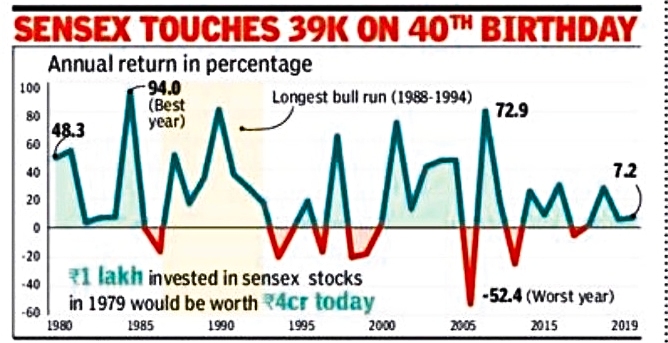

I came across an article in last week’s newspaper:

Sensex: Indian stock market index, celebrated its 40th birthday on 1 April 2019. Actually launched on 2 January 1986, the base date was 1979, for simplicity sake, the value of the index was 100 in 1979.

Forty years later, the value of the index is near 39,000. The simple average annual return is around 16%, if we include the dividends paid over the years, it would be close to 56,000, a return of around 17%.

Now the difference between the rate at which the value of my house appreciated:12% and the Sensex return: 17% is not much: only 5%.

However, 1 lakh invested on 1 April 1979 in Sensex would now be worth 5.6 crore!

Long story short:

- We are patient with our Real Estate investments, let us look at Equity/Mutual Funds with the same long term perspective.

- Let us put more eggs in the basket(s) which give higher return: Asset Allocation is the key.(As of today, majority of India’s savings are in Real Estate and Fixed Deposits).